Bitcoin’s price movement over the past week has been nothing short of dramatic. After hitting highs near $100,000 earlier in February, BTC plunged by over 21% in just seven days, reaching lows of $78,300. This rapid decline led to over $1.6 billion in leveraged long liquidations, triggering a wave of forced selling.

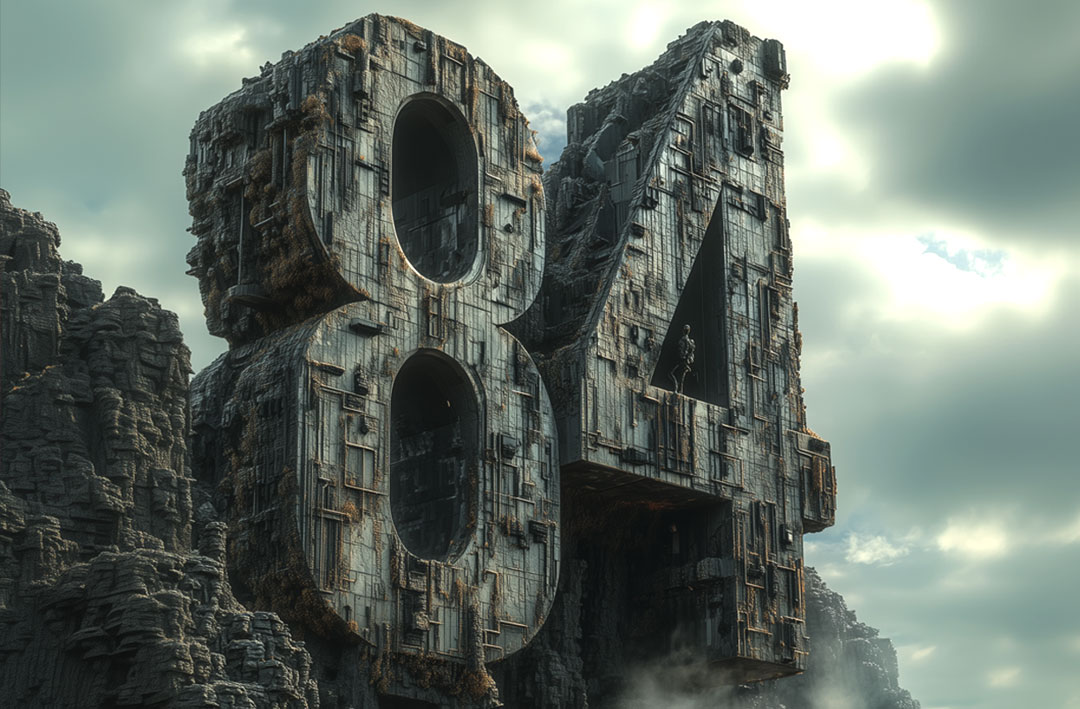

Despite the sell-off, Bitcoin’s price quickly rebounded, recovering to $84,000. This price action has sparked a debate: was this a temporary correction, or is there more downside ahead?

What’s Behind Bitcoin’s Price Drop?

1. Macroeconomic Pressures

Global economic uncertainty has played a major role in Bitcoin’s recent volatility. New trade policies, inflation concerns, and shifting investor sentiment have created a cautious market environment.

Gold, often viewed as a safe-haven asset, also saw a 2.2% decline in the past few days, suggesting broader market unease. Additionally, investors have been flocking to U.S. Treasurys, further reducing liquidity in riskier assets like Bitcoin.

2. Institutional and ETF Movements

Institutional adoption of Bitcoin has been a key driver of its price in recent months. However, recent outflows from Bitcoin exchange-traded funds (ETFs) have raised concerns. Data shows that over $1.1 billion exited spot Bitcoin ETFs on Feb. 24 alone, signaling hesitation from large investors.

3. The Impact of Bitcoin Derivatives

Another significant factor in Bitcoin’s price movements is the role of the derivatives market. The upcoming $6.9 billion Bitcoin options expiry on Feb. 28 has traders on edge.

Data suggests that many call options (bullish bets) are positioned above $88,000, meaning that if Bitcoin remains below this level, those contracts could expire worthless. This has created short-term selling pressure as traders adjust their positions ahead of the expiry.

Signs of a Bitcoin Comeback?

Long-Term Holders Remain Steady

Despite the recent volatility, on-chain data suggests that long-term Bitcoin holders have largely remained unfazed. Reports indicate that 74% of realized losses came from short-term traders who bought Bitcoin within the past month. This suggests that more experienced investors are holding firm, seeing the dip as a temporary setback rather than a long-term reversal.

Integration With Traditional Finance

Bitcoin’s increasing integration with traditional finance is another factor that could support its recovery. Some banks and financial institutions are exploring ways to use Bitcoin as collateral for structured financial products. Additionally, discussions around regulatory clarity could further legitimize Bitcoin’s role in mainstream markets.

Where Does Bitcoin Go From Here?

With Bitcoin hovering around $84,000, the market remains at a critical juncture. The upcoming options expiry and continued macroeconomic developments will likely shape BTC’s short-term direction.

While some analysts believe Bitcoin could reclaim $95,000 in the coming weeks, others caution that further volatility is possible. Regardless of short-term price swings, Bitcoin’s long-term fundamentals remain intact, with continued adoption and institutional interest playing a key role in its future trajectory.

Final Thoughts

Bitcoin’s recent rebound has reassured some investors, but the market remains unpredictable. As always, staying informed about key trends and developments is essential in navigating the evolving crypto landscape.